A friend of mine decided to rent his unit and reached out to me with a few questions. As I usually do, instead of just providing the specific answers to specific questions, I decided to write a blog post and point him to it. I realize this isn’t a massively popular top-of-the-mind topic for most of my readers. However, there may be two people on the internet who will find this information relevant. This article is a basic, condensed, yet complete guide to becoming a landlord and renting your apartment in the US. In the 5 minutes, you spend on this page, you will know if being a landlord is your thing.

Is rental property a good investment?

There are countless videos and articles on this topic and the truth is usually in the eye of the beholder. The market is vastly different state by state and even county by county – property prices, taxes, job opportunities for your tenants, tenant stability, natural forces (flooding, tornadoes), infrastructure investments by local municipalities, the list goes on. On the flip side, your circumstances play an important role in this decision as well – do you need a cash flow or are you looking at property appreciation for leverage, are you are a real estate professional, do you like doing property maintenance, etc.?

In general, the US tax code is written favorably for landlords. If you are a licensed real estate professional and operate a business (even out of your home), then the rental property is a great investment. You get to write off almost every expense possible as a tax deduction and increase your ROI. You can expense maintenance costs, trips, advertising fees, and of course the most attractive part of real estate investment – property depreciation.

On the other hand, if you have a day job and rental property is just another source of income, the answer will likely be a NO. You are unlikely to score the top dollar for your rental property, certain tax breaks will not apply to you, the taxable amount will be higher and you still have to put in the time to manage the property.

7%

Is this return on investment (in terms of a cash flow) attractive enough for you to justify the hassle? If so, on to the next paragraph. If not, take your money and put them into the stock market. S&P 500 has been averaging 10% for the past 30 years. In recent years, due to changes in the economy caused by the pandemic, you can see 20% – 40% returns annually.

Before you make a final call – consider the sentimental value of the property. Do you have childhood memories that bind you to the property or do you want to retire in it someday? There may be a counterweight to put on the other side of decision scales. If none of those are true – real estate investment is not worth it for an average weekend warrior real-estate professional.

Estimate your cash flow

Cash flow is the difference between the money coming into your bank account and leaving it to cover capital and operating expenses. If you don’t break even then starting a rental business is not a good idea. Let’s look at categories of income and expenses you will run into.

Income

- Monthly rent payments

- (Optional) Parking spot rental

- (Optional) Storage space rental

Expenses

- Home owner association dues

- Property taxes

- Rental insurance

- On-going property maintenance

- Utilities

- Damages and expensive repairs

- Office supplies

- Advertising fees

- Tenant screening fees

Expenses if you don’t own the property

- Mortgage principal, interest and escrow

- Mortgage insurance

Tax Deductions

- Property depreciation

- Property taxes

- Home owner association dues

- Maintenance

- Tenant placement

- Legal and professional fees

- Travel and auto expenses

- Office supplies

- Property management fees

- Passive activity loss (real estate professional only)

Tax deductions if you don’t own the property

- Morgage interest

- Morgage origination points

Key points to note:

- You can write-off most of your expenses

- You can actually look “in the red” on paper while having a positive cash flow

- It is very hard for the property to generate a positive cash flow if it has a mortgage

Business mindset

Congratulations, you are running a business. You need to stay on top of everything and keep track of everything with high precision. Mistakes, communication gaps, or non-compliance will be costly financially and legally. Running a business is a commitment of time and effort. If you don’t think you got the time or are willing to put in the effort, better not start at all.

Here’s what you need to prepare for running a rental business:

- A separeate checking bank account. This account will store the security deposit and manage the cash flow.

- Accounting software or a professional accountant. You will need to track money and upcoming bills accurately to balance the books. There are a few options on the market – check out my comparison of Quicken with GnuCash.

- A lawyer. As the joke goes – in case of cabin depressurization, put the oxygen mask on the lawyer first. You will need a professional to help you put together the lease agreement and advise on disputes with the tenant.

- Office supplies. You will be sending and receiving letters, printing and scanning papers, depositing checks, etc. Stock up on the paper, envelopes, stamps, a good printer/scanner, a binder for all checks and receipts, etc. You will collect a lot of paper and will not be able to get rid of it for a while so a sizeable cabinet would be handy.

- Redundant storage with cloud backup. You will be keeping track of all exchanges with the tenant in paper as well as digital form. You will need 1 or 2 more copies, just in case. I use 2 external hard drives and back up everything into the cloud, in case my house catches on fire.

Property management

You may feel overwhelmed with information and think that hiring a property management company is a good idea. It is a waste of money for a single rental property. They charge $100 a month for services you could do in 15 minutes. You may be thinking – “Hey, I can write off that property management fee”. True, you can. However, it still reduces your cash flow by $1200 a year. The actual property management fee structure is based on the percent of the rental income and can differ depending on the package you buy so it gets complicated. My point is, you can do everything your property management company will do for you, for free.

Prepare your apartment for the market

You are offering a product (your apartment) to the market hence typical market dynamic will take place. If people like your apartment (demand rises) then you can raise the price and be choosy about the tenants. You need to invest a bit of time and money to make your apartment look attractive for future tenants. The location alone is a big factor, but there are multiple properties around you that people can rent. Make them want to rent your property.

- Repair broken or worn-out structural components and appliances. Broken door knobs, leaking faucets, dead sockets, damaged carpets or hardwood floors should be taken care of before yoru renters move in. Safety and insurance hazards must be addressed. Not only those items lower the market price of the apartment, but it will also be more costly and invonvenient to fix once the unit is occupied.

- Upgrade appliances that approach their end of life. New appliances are very attractive to prospective tenants. They will choose a unit with a new washer or dryer over a unit with a 20 year old machine. Refresh the light fixtures, evaluate if the bathroom air vents need an upgrade. If windows are shot – get them replaced as well.The idea is to pay for all upgrades in 1 go and reduce maintenance cost for a few years.

- Paint the unit. This is a effective way to give your unit a fresh smell and look. Consult with an interior designer and hire a professional to paint the walls, ceiling, doors, etc. Light colors create a visual illusion of a larger space.

- Clean the unit. Wash the carpets, clean the windows, wash the toilets, replace the air filters, clean the dryer vent, etc. There should be no signs of you living in that apartment in the past.

- Change the locks. To avoid surprise visits from people who may have copies of your keys, it is advised to change the locks and fix broken latches. A new tenant will be more likely to rent if they know they control access to the unit.

All of these upfront expenses are tax-deductible so you should feel free to splurge a bit.

Prepare the documents

Homeowner associations tend to limit the number of apartments available for rent to keep the property value high. Make sure you notify them of your intent to rent and get the approval before you go ahead and rent the unit.

Change your insurance policy from homeowner to rental. It is a different policy that protects you from liability in case someone gets injured on your property or the property itself gets damaged by natural forces or break-in. Generally, there are 3 policies in place to cover all situations:

- Building is covered by an insurance policy paid by homeowner assicoation from your dues. This policy covers everything “walls out”.

- Rental policy protects you in case something happens insidwe your apartment. You need to get this policy. Typical premium is $300 – $500 a year.

- Tenant policy protects both you and the tenant in case something happens to the property of poeple renting your apartment. This policy is taken by your tenants.

Prepare the lease agreement and create templates of documents/letters you will need to communicate with your tenants. A good way to go is to buy the whole package from LegalZoom. Here’s what you need:

- Lease agreement is a legally binding document explaining the terms of the lease and responsibilities. This document is one of the most important ones because it can settle disputes before they even take place.

- Lease application you will hand to people interested in renting your apartment.

- Security deposit receipt you will give to your tenants when they pay the security deposit.

- Welcome package should include most necessary information about the property (e.g. your phone number and email) and remind the tenants about key dates and sums of money.

- Move-in check list captures the state of your property when tenants move in. You will use it to document every single item, whether damanged or not. Have your tenants sign the document acknowledging accuracy.

- Move-out check list is the same document as move-in check list, except you document it when tenants are moving out. You will compare this document to the move-in check list to determine if you are entitled to any money from the security deposita according the lease agreement.

- Digital key codes and keys receipt document list all the keys you are giving to the tenants and expect to receive when they move out

- Rent receipt is a template you fill out every month and send them when you process their checks. Yeah, you have to issue receipts.

- Invoice – occasionally your tenants will incure expenses that you will have to pay for. Use an invoice to collect the funds. For example, if you tenants damage the common area of the building while moving or out, your HOA will charge you for repairs. You will use this invoice to recover the funds from the tenants.

- Rent default notice is something you hope to never need to mail, but you need to have it nevertheless.

Once you have the package ready, get it vetted by a lawyer who practices in the area. Laws differ city by city and it is wise to have a lawyer read your lease agreement and make changes to your advantage. Some parts of your lease agreement may be unlawful or unenforceable so it doesn’t help to have them in the document. For example, a sum of money you can charge for late payment can’t be $10,000 a day even if you wish so.

Put the apartment on the market

It is easier than ever to let your future tenants find your apartment online. No need to order newspaper ads or print posters.

Once you are done painting and repairing the unit, wait for a sunny day, open the blinds and snap a bunch of pictures with a DSLR camera with a wide-angle lens (e.g. 17 mm). Process them in photoshop, color grade, and export JPEGs for publishing. Did I lose you here? No worries – hire a photographer. Do not do this part with an iPhone.

- Facebook marketplace is my top choice for advertisemnt. It has a lot of eyes on it and you start getting messages within an hour of posting an ad.

- Zillow and Redfin are fairly popular services. It would be wise to register your property with them and mark it as open for rent.

- Apartments.com is also a big resource but I haven’t had a lot of success with tenants from them.

- Craigslist is the last resort advertisement platform. Use them to generate additional leads but expect scam.

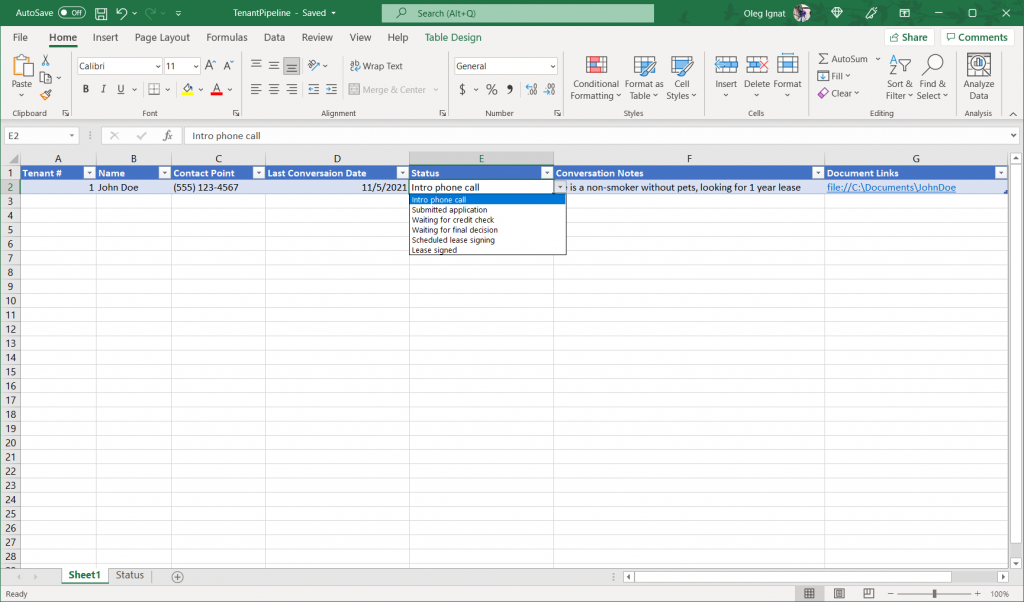

Run the tenant pipeline

There is some similarity between hiring an employee and finding a good tenant – you will track multiple people at the same time at different stages of their application process. Do not try to keep it all in your mind – you will lose context and forget things. Spreadsheets are the best tools for the job. Feel free to download my tenant pipeline Excel workbook.

Every time you interact with a potential tenant, receive their application, make a decision or take any action at all – always mark it in the pipeline spreadsheet. Precision is key. Once you have 10 people interested in your apartment, you will not be able to track them individually without this pipeline.

It helps to group multiple people to view your apartment on the same day but at different times. Allocate 30 minutes for each tenant to view your apartment and schedule them one after another. This way you get a predictable block of time on your calendar and each tenant gets to see the unit individually.

Before tenant leaves your property hand them 2 pieces of paper:

- A pamphlet with all the reasons they should rent your apartment over any other in your area

- An application for them to fill and submit when they are ready to move forward in the process. Expect people to turn in applications on the same day if they are interested. That’s where “Last Conversation Date” column on the spreadsheet comes in handy. If it’s been a week since last viewing – time to move on.

Screen applicants

A great tenant who pays on time and takes good care of your property is worth more than the first tenant willing to accept your terms. The creditworthiness of the tenant is indicative of their habits and level of responsibility. RentPrep is a good way to check public information about the tenant and run their credit report. Do not entertain tenants with:

- Poor credit score. They do not pay on time and getting the rent out of them is like pulling teeth.

- Tenant who promises the bright future but is teporarily constrained on finance – if only he or she could get a bit of support from you.

- Tenant in the rush to rent today, or is renting a place without ever stepping into it. Anything that deviates from the peak of the bell curve distribution of tenant behavior is a yellow flag.

The best tenants are “boring” and “predictable”. They have typical reasons for moving (new job, promotion, closer to school, etc.). To gain insight about the tenant ask the following questions:

- What kind of work do they do? (look for job stability and compensation relative to the montly rent you are asking)

- Do they have pets? (look for aggresive breed of pets)

- Do they smoke? (be prepared to deal with entire unit smelling like a bar)

- How many people will live with them permanently and how many will visit them?

- Are they willing to sign a 2 year lease? (if not, consider the cost of looking for a new tenant within a year)

Look at the state of the car they drove to view the apartment. If it is full of trash or hasn’t been washed in a long time – that’s what will happen to your apartment as well. People do not change habits between places.

Sign the lease

You found a perfect tenant and notified them of your decision to move forward with them. You scheduled the date of lease signing at the property. Here’s what you do next.

- Collect a cashier’s check for the security deposit and give them a security deposit receipt. Do not proceed to signing the lease if tenant doesn’t provide the security deposit.

- Bring the lease agreement and have the tenant read it and sign first. Do not sign the application yourself until the tenant has done so. Make sure your tenant puts their initials on every page of the agreement to acknowledge they read that page.

- Lease agreement must include move-in date to make it clear when tenants can take possession of the property.

- Walk around the unit with the tenant and complete move-in checklist. Write down the state of every wall, door, fixture, appliance, floor tile, etc. Be as precise as possible. Make sure you and tenant agree whether each item listed is in working condition. Take a picture of every item on the check list.

- Give tenants the keys and list every key they received on the key receipt document. Have them sign it.

- Hand the tenant the welcome package and shake hands. You are done with all the hard work.

Two provisions must be included in your lease agreement:

- A tenant must carry a tenant insurance. It will protect them and their property.

- The landlord (you) must be one of the beneficiaries of their insurance policy. It will protect you if their guest breaks a leg on your property, metaphorically speaking.

When you return to the office, make a copy of every document, scan them and provide a copy to the tenants for their reference. Let the paperwork bonanza begin.

Process payments

Every month you will get a check in the mail. You will need to cash the check and mail the receipt back to the tenant. Rinse and repeat the next month and so on until the end of the lease.

If you get a bill for something your tenant did that is not covered under the terms of the lease, send them an invoice with a due date.

Take a picture of every document you receive or send to the tenant. You don’t want to be “crossing your heart” to the judge in case of a dispute. A picture is a piece of evidence you can use to resolve disagreements if the tenant claims he or she didn’t receive a document from you.

Connect your money management software to your checking account and record every transaction and bill due. Automate all payments you owe on the property and do not forget to pay your property taxes on time.

Expect to spend about ~15 minutes a month on recurring payments and about ~2 hours annually on less frequent transactions, like taxes.